With ongoing debates surrounding your federal income tax obligations, you may wonder if the Supreme Court ever declared income tax unconstitutional. This topic challenges the foundation of America’s tax system and questions whether your hard-earned money is being lawfully taken. Understanding the Supreme Court’s rulings, the 16th Amendment, and your legal rights empowers you to navigate tax laws confidently. This article sheds light on the legal controversies and historical facts that impact your relationship with the IRS and highlights why you deserve clear answers backed by constitutional law.

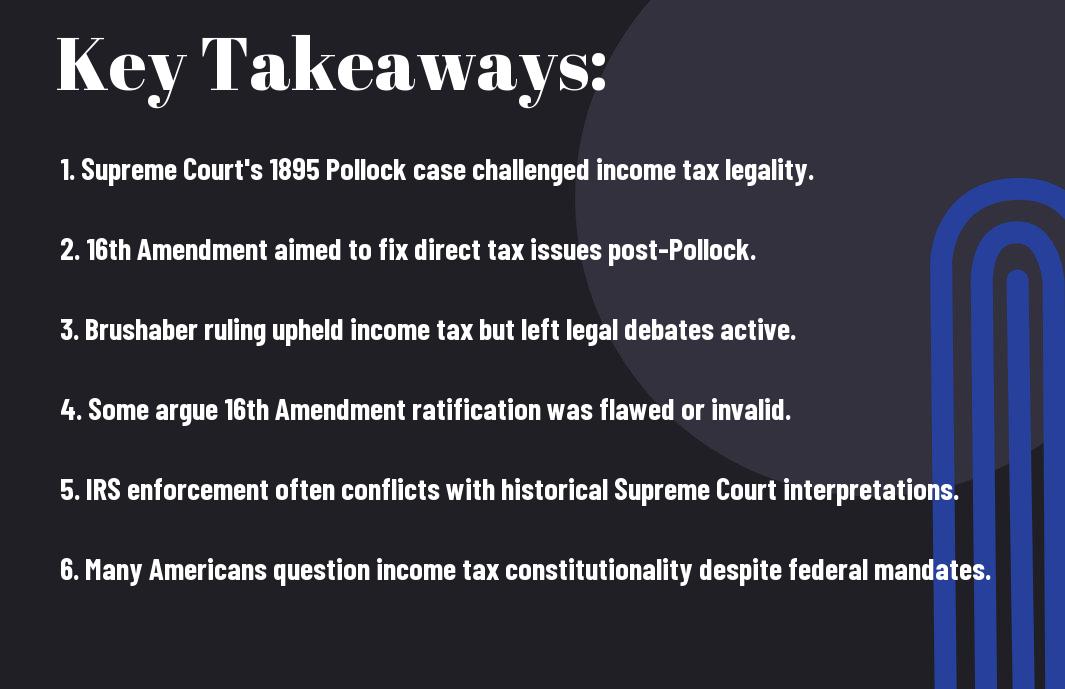

Key Takeaways:

- Several Supreme Court decisions, including Pollock v. Farmers’ Loan & Trust Co. (1895), historically challenged the constitutionality of direct income taxes before the 16th Amendment was ratified.

- The 16th Amendment was introduced to provide explicit constitutional authority for federal income tax, yet debate persists regarding its proper ratification and legal interpretation.

- Cases like Brushaber v. Union Pacific Railroad (1916) and Stanton v. Baltic Mining Co. (1916) are often cited to support both legitimacy and ongoing questions about the federal income tax’s constitutional foundation.

- Many pro-Constitution advocates argue that the IRS enforces tax laws based on misunderstood or misapplied Supreme Court rulings, fueling controversy over taxpayers’ legal obligations.

- The ongoing constitutional debate highlights the importance of understanding both historical rulings and current law to protect American citizens from potential government overreach in taxation.

The Constitutional Basis of Income Tax Law

The United States federal income tax is grounded in a complex legal framework evolving over centuries, yet many question its constitutional validity. You should understand that the 16th Amendment, ratified in 1913, is the legal foundation granting Congress the power to levy income taxes without apportioning them among states. However, debates persist over the amendment’s original intent and interpretation. Knowing the Constitution’s role in your tax obligations helps you assess the legitimacy of federal income tax enforcement and form your own informed stance.

Historical Context of Taxation in the United States

Behind early U.S. tax laws was the notion of temporary levies, primarily to fund wars and national emergencies. Your federal income tax origins trace back to the Civil War era, where income taxes were first introduced then repealed after necessity passed. This historical pattern feeds ongoing debates, as many argue income tax was never meant to be permanent, fueling claims that current enforcement conflicts with the Constitution’s original framework.

The Framers’ Intent: What the Constitution Says

An original understanding of the Constitution reveals that direct taxes, including income tax, were to be apportioned among states according to population. This design aimed to balance power between federal and state governments. The absence of explicit income tax provisions in the original text makes you question whether the framers intended this tax form as constitutional without amendment-based changes.

And when the 16th Amendment was introduced, it was meant to clarify that income tax did not require apportionment. However, some argue this amendment’s ratification process and wording are legally dubious, leaving room for debates about the legitimacy of income tax laws as applied by the IRS against American citizens like you.

The Evolution of Taxation Laws Through History

United States tax laws evolved through Supreme Court rulings and legislative changes responding to economic and political pressures. Landmark cases such as Pollock (1895) initially declared income tax unconstitutional, but Brushaber (1916) upheld income tax legitimacy post-16th Amendment. These rulings shaped your current tax system but also opened constitutional questions that remain unresolved for some citizens.

To fully grasp your tax obligations and rights, consider how shifts in law reflect the tension between federal authority and constitutional limits. Some Americans believe this evolution contains “loopholes” enabling unconstitutional enforcement, which motivates ongoing legal challenges and public debate about the future of federal income taxation.

The 16th Amendment: A Turning Point

While many believe the 16th Amendment simply legalized the federal income tax, it actually marked a significant constitutional shift that transformed how the government funds itself. Before its ratification in 1913, income taxes faced serious Supreme Court challenges, raising questions about their legality. This amendment provided the legal foundation for federal income tax, but its interpretation and enforcement have sparked decades of debate. Understanding this turning point helps you see why some Americans question the legitimacy of income tax and the authority the government claims over your earnings.

The Necessity of the 16th Amendment During Economic Crisis

About the economic realities of the early 20th century, the 16th Amendment emerged as a means to increase federal revenue without relying on tariffs or excise taxes, which were weakening. Amid financial instability, Congress needed clear constitutional authority to collect a progressive income tax, aiming to stabilize government funding. For you, this means the amendment was framed as a response to economic strain but opened doors for permanent taxation powers that some argue have since overstepped original limits.

Text and Interpretation: What the 16th Amendment Actually States

Pointedly, the 16th Amendment states: “The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.” This language removes previous constitutional hurdles but does not explicitly define how your income is taxed or shield you from disputes over tax obligations. Understanding this exact text is important to grasp both the scope and the confusion surrounding your federal tax responsibilities.

Actually, the amendment’s wording is succinct but deliberately broad, giving Congress sweeping power to tax “incomes” yet leaving loopholes for interpretation and enforcement. For you as a taxpayer, this means there is room for legal challenge but also a strong foundation for the IRS’s authority. Examining this precise language helps reveal why arguments about income tax legality persist and why courts often side with federal enforcement.

The Impact of the 16th Amendment on Federal Taxation

Beside establishing a legal basis for income tax, the 16th Amendment enabled the rise of the graduated tax system, allowing higher earners to be taxed at greater rates without the restrictions of apportionment. This fundamentally altered the federal government’s role in citizen finances, making income tax a permanent fixture rather than a temporary measure. For you, it means your income has been subject to layers of tax authority that continued evolving after the amendment’s ratification.

Amendment implementation created a pathway for Congress to expand taxation beyond direct taxes, dramatically increasing government resources but also raising ongoing debates about fairness and constitutional limits. As you navigate tax obligations, it’s important to recognize that the 16th Amendment’s effects reach deep into your financial interactions with the federal government, shaping your tax duties and the legal landscape around them.

Supreme Court Cases Pre-1913: Early Challenges to Income Tax

Unlike popular belief, the constitutionality of federal income tax faced serious legal challenges well before 1913. Early Supreme Court cases raised significant questions about the government’s power to impose income taxes. These cases revealed constitutional ambiguities that have fueled ongoing debates about your obligations under federal tax laws. Understanding these precedents helps you see how the foundation of income tax law was never as solid as the IRS claims.

Pollock v. Farmers’ Loan & Trust Co. (1895) and Its Implications

Around 1895, the Pollock ruling declared parts of the federal income tax unconstitutional because they were considered direct taxes that were not apportionable among the states. This decision effectively limited Congress’s ability to tax incomes from property, impacting how you might view the federal government’s taxing powers today. The case deeply influenced tax legislation and fueled legal arguments that persist in questioning the IRS’s authority.

The Legal Argument for Direct vs. Indirect Taxes

Against the backdrop of Pollock, the distinction between direct and indirect taxes became a legal battleground. You should know that direct taxes, according to the Constitution, must be apportioned among states, while indirect taxes do not. The federal income tax was challenged as a direct tax that violates this rule, providing a substantive basis for questioning the legality of your income tax obligations without proper apportionment.

Taxes categorized as direct require strict adherence to constitutional rules, which calls into question the typical federal income tax methodology applied to you. This legal nuance creates a significant potential for constitutional challenges against income tax enforcement, given that many incomes taxed are derived from property and investments, fitting the definition of direct taxes.

Legislative Responses Post-Pollock Decision

Trust in the Pollock case’s impact led Congress to seek new ways to validate the income tax without violating the Constitution. This legislative maneuvering ultimately set the stage for the 16th Amendment. Knowing this helps you contextualize the federal income tax’s modern legal basis and understand the legislative intent to bypass strict constitutional limitations.

Plus, Congress’s response after Pollock was to propose the 16th Amendment, explicitly authorizing income taxes “without apportionment.” This move was designed to override previous constitutional barriers, but it also opened the door to ongoing debate about whether this amendment was fully ratified and legitimate, a question still relevant to your rights and tax responsibilities today.

Supreme Court Rulings Post-16th Amendment

Once again, you encounter the complex legal landscape shaped by the Supreme Court after the 16th Amendment’s ratification. While some claim the Court ruled federal income tax unconstitutional, the reality is far more nuanced. The Court addressed the tax’s legitimacy through landmark cases, confirming and sometimes limiting Congress’s taxing powers. Understanding these rulings helps you realize that despite ongoing debate, the federal income tax system stands on a primarily upheld legal foundation, though contradictions remain that fuel continued controversy among law-abiding Americans like you.

Brushaber v. Union Pacific Railroad (1916): Legality Affirmed

The Supreme Court in Brushaber v. Union Pacific Railroad explicitly affirmed the constitutionality of the income tax after the 16th Amendment. This ruling clarified that income tax is not a direct tax subject to apportionment among the states, thereby validating Congress’s authority to impose a federal income tax. If you question the tax’s legal standing, Brushaber serves as a powerful legal precedent that nullifies many claims challenging income tax legitimacy on constitutional grounds.

Stanton v. Baltic Mining Co. (1916): Limits of Federal Taxing Power

After Stanton v. Baltic Mining Co., the Court established important boundaries on the federal government’s taxation powers. While the ruling confirmed that income tax is lawful, it also emphasized limits on how Congress may tax income derived from specific sources. This means your tax obligations depend on the nature of the income and the taxation method, adding complexity to your understanding of tax law enforcement.

Pacific Legal scholars analyze Stanton to reveal how it restricted the federal reach over certain income types, notably mining profits, signaling that the federal taxing power, though broad, is not without constitutional checks. The decision highlights that tax laws must align strictly with defined legal principles, something you should consider when evaluating the IRS’s claims over your income.

Subsequent Rulings and Their Contradictions

Limits and inconsistencies in later Supreme Court rulings have kept the income tax debate alive. Some cases appear to support enforcement, while others raise questions about overreach, leaving you with mixed messages about the tax system’s true constitutionality. These contradictions continue to fuel skepticism among law-abiding Americans seeking clear legal answers.

Supreme Court precedents sometimes contradict each other on federal taxation’s scope, contributing to confusion that IRS enforcement may not always align with original constitutional intent. This inconsistency creates a legal landscape where you must carefully examine case law to understand your rights and potential exemptions, highlighting the ongoing tension between federal tax collection and your constitutional protections.

The Concept of Income Tax: Voluntary or Mandatory?

After decades of debate, many Americans still question whether federal income tax is truly mandatory or merely voluntary. The notion that paying income tax is voluntary stems from misunderstandings about IRS language and legal obligations. In reality, while filing a tax return can feel like a choice, your obligation to report income and pay taxes is mandated by law. This distinction fuels ongoing controversy, especially among those who believe the tax system infringes on constitutional rights, yet the law clearly requires compliance, with consequences for nonpayment.

IRS Definitions and Legal Framework

Behind IRS terminology lies a complex legal framework designed to define income tax responsibilities. The IRS uses the term “voluntary compliance” to highlight your duty to self-report income accurately, not to imply that paying taxes is optional. This phrase means you must honestly disclose your earnings, enabling the government to enforce tax laws effectively. Understanding this legal foundation is important because it clarifies that while the system relies on your cooperation, failure to comply triggers enforcement actions backed by federal law.

The Misinterpretation of Voluntary Compliance

Below IRS language has often been misread, leading to the false belief that income tax is optional. The phrase “voluntary compliance” does not exempt you from paying taxes but indicates that you must voluntarily file returns and disclose income. Misinterpreting this places you at risk, as courts have consistently upheld your legal duty to pay taxes. Many pro-constitution Americans find this language confusing, but it’s not a loophole for avoiding taxes, rather a system relying on your good faith fulfillment of tax laws.

Legal arguments claiming that voluntary compliance means optional payments ignore key statutory language and Supreme Court rulings. The courts have distinguished between voluntary in the sense of self-reporting and mandatory in the sense of paying what is owed. This misinterpretation can leave you vulnerable to audits, penalties, and criminal charges, demonstrating why clear understanding is vital to protect your rights while complying with tax laws.

Legal Consequences of Tax Evasion

Around 10,000 Americans are prosecuted annually for tax evasion, underscoring the federal government’s seriousness about enforcing tax laws. Tax evasion—willfully failing to pay or underreporting income—can lead to steep penalties including fines and imprisonment. If you ignore your tax obligations believing they are voluntary, you expose yourself to severe legal repercussions that can jeopardize your personal and financial freedom.

Evasion of federal income tax carries both civil and criminal consequences. The IRS can impose heavy fines, liens on your property, and even seek imprisonment. Courts have made it clear that ignorance or misinterpretation of tax obligations offers no defense. Staying informed and compliant is the best way to avoid these risks, ensuring you maintain your status as a responsible citizen upholding your constitutional duties within the law’s framework.

Legal Arguments Surrounding Income Tax Legitimacy

Now, you might wonder if federal income tax truly stands on firm constitutional ground. The legal debates often center on interpretations of the 16th Amendment and various Supreme Court rulings. Many argue that income tax contradicts the original constitutional framework, claiming it oversteps congressional authority. Meanwhile, counterarguments emphasize historical court decisions like Brushaber v. Union Pacific Railroad that upheld tax powers. Understanding these nuanced legal arguments is important if you are seeking clarity about your rights and the legitimacy of income tax enforcement.

The Claim of Taxation as Theft

Legal critics often label federal income tax as taxation as theft, arguing the government forcibly takes your earnings without explicit consent or fair representation. This view holds that income tax violates fundamental property rights embedded in the Constitution. You may find this perspective compelling, especially when contemplating mandatory payments enforced even after prior legal challenges. This claim reflects a broader dissatisfaction with what many see as a coercive tax regime affecting millions of Americans.

Suspicions of Misapplication of the 16th Amendment

Across various legal circles, you’ll encounter strong suspicions that the 16th Amendment has been misapplied or misunderstood since its ratification. Critics argue that its original text never clearly granted Congress unrestricted power to tax all income. This debate fuels claims that the amendment’s enforcement exceeds its lawful intent, challenging the tax system’s foundation.

Indeed, the heart of these suspicions lies in questions about whether the 16th Amendment was correctly ratified and whether it was meant to eliminate constitutional safeguards against direct taxation. This ongoing controversy leads many like you to question how much of your income is lawfully taxable and whether historical interpretations have distorted the amendment’s purpose for over a century.

Ongoing Legal Battles and Resistance Movements

Any discussion about income tax legitimacy must include the persistent legal battles and resistance movements across the United States. You may observe groups actively contesting tax enforcement through court cases, public protests, and educating others on constitutional rights. These efforts aim to reclaim what they believe to be unlawfully seized property and push for judicial review or reform.

Theft accusations fuel these movements, which challenge the IRS and federal government’s authority using constitutional arguments emphasizing personal sovereignty. If you align with these concerns, understanding these ongoing efforts can empower you to effectively navigate and potentially resist what you view as unconstitutional taxation.

The Role of the IRS: Authority and Accountability

Not many realize that the IRS wields immense power in enforcing federal income tax laws, often operating with limited oversight. While it claims authority under the 16th Amendment, many legal experts and court rulings have questioned whether its enforcement fully aligns with constitutional mandates. You need to understand that the IRS’s authority is not absolute, and its accountability remains a contentious issue in the debate over your rights and the legality of income tax enforcement.

History and Formation of the IRS

Below the surface of the modern IRS lies a complex history beginning with the Civil War-era Bureau of Internal Revenue, created to fund wartime debt. Evolving through decades of legal battles, it formally adopted the name IRS in 1953. Its formation reflects the government’s expanding power to extract revenue, but many argue this growth challenges your constitutional protections against unlawful taxation.

Audits and Their Constitutional Basis

Formation of IRS audits traces back to laws designed to enforce federal tax compliance, yet the constitutional grounding for these audits remains debated. You should question whether the IRS’s use of audits oversteps limits imposed by amendments and Supreme Court rulings, especially since some courts have ruled income tax powers must adhere strictly to legal parameters.

Audits function as the IRS’s primary tool to enforce tax laws, scrutinizing your financial records to verify reported income. However, their constitutional basis is controversial; the original tax laws and key Supreme Court decisions, such as Pollock v. Farmers’ Loan & Trust Co., raise concerns about whether these audits infringe on protections against unreasonable searches and the requirement for taxes to be apportioned properly. You must recognize that while audits appear routine, they rest on legal premises that have never been unanimously settled.

The IRS as a Regulatory Agency: Limits and Powers

For you, understanding the limits of the IRS’s regulatory power is vital. While the agency enforces tax laws, it does not have unlimited authority to impose or interpret laws beyond what Congress and the Constitution allow. Knowing these limits helps protect your rights against potential overreach in tax assessments or collections.

History shows the IRS’s role has expanded, wielding powers that some argue exceed constitutional bounds. The agency’s ability to compel payment, conduct audits, and seize assets is strong, but not unchecked. You have legal protections against arbitrary enforcement and must hold the IRS accountable to the scope granted by the Constitution and the 16th Amendment. However, the agency’s broad authority and aggressive enforcement tactics continue to spark debate about whether your fundamental rights are being compromised under the guise of regulatory power.

Philosophical Perspectives on Taxation

Despite ongoing controversy over federal income tax, you must consider the deep philosophical roots shaping taxation debates. Ideas about individual rights clash with collective responsibilities, sparking heated arguments on whether taxation is an imposition or a necessary civic contribution. Your understanding of these perspectives helps clarify why some view income tax as unconstitutional enforcement, while others see it as a legal duty underpinning the Republic’s functioning.

Taxation as a Social Contract vs. Individual Liberty

Liberty is at the heart of your questioning federal income tax’s legitimacy. You face a tension between honoring personal freedom and accepting the social contract that binds citizens to contribute financially for government operations. For many, this balance feels skewed, suggesting taxation intrudes excessively upon your constitutional protections, raising doubts about the tax’s true legal and moral standing.

The Economic Debate: Fairness and Distribution of Wealth

Philosophical arguments about fairness challenge your view on progressive income tax systems. The intention is to redistribute wealth equitably, yet you might see this as an exploitative mechanism undermining your property rights. This debate fuels claims that the graduated tax system creates a constitutional loophole exploited beyond original amendment intentions, spurring calls for reexamination of tax laws.

With economic inequality growing, you recognize how taxation policies shape wealth distribution, potentially discouraging productivity while attempting to balance societal needs. Understanding this nuanced relationship helps you assess if current tax enforcement aligns with the Republic’s foundational principles of consent and fairness, or if it reflects overreach demanding judicial review.

Moral Implications of Tax Collection

With every dollar taken, you confront moral questions about the legitimacy and fairness of federal income tax. Is your contribution a just civic responsibility, or is it coercion under threat of penalties? These concerns illuminate why many Americans question the constitutionality of enforced income tax and the ethics behind IRS actions, especially when historical rulings are seemingly contradictory.

Perspectives on tax morality expose a divide: some uphold taxation as necessary for societal order, while others argue it infringes on your natural rights and property ownership. This debate calls on you to evaluate the IRS’s role critically and consider whether the system upholds justice or perpetuates a legal deception spanning over a century.

The Future of Income Tax in America

Keep an eye on growing debates surrounding federal income tax as questions about its constitutionality and enforcement intensify. With rising skepticism, you could witness shifts in public sentiment and legal challenges that question the very foundation of the 16th Amendment. As reforms are discussed, understanding your rights and the government’s strategies will empower you to engage more effectively in this ongoing conflict. The future may hold pivotal changes that redefine how your income is taxed—or if it’s taxed at all by the federal government.

Likelihood of Legal Challenges to Current Tax Structure

Any attempt to dismantle or reform the income tax system faces uphill battles, but a growing number of legal activists assert the 16th Amendment was improperly ratified and seek to revive past Supreme Court rulings that questioned federal income tax legitimacy. While the courts have traditionally upheld the tax, ongoing challenges remind you that the tax’s constitutional foundation is not beyond dispute, potentially opening the door for future cases that could reshape federal tax enforcement.

Potential Reforms and Alternatives to Current System

Structure reforms are increasingly discussed as citizens and lawmakers explore alternatives such as consumption taxes, flat taxes, or the elimination of the federal income tax altogether. If implemented, these changes would directly impact your financial obligations and possibly reduce federal overreach. Understanding these alternatives equips you to advocate for a tax code that respects constitutional limits and promotes fairness instead of burdening taxpayers unfairly through complex regulations and enforcement.

Future reforms could pivot away from the current progressive income tax system towards simplified options like national sales taxes or flat taxes, which proponents argue align better with constitutional taxation powers. These alternatives emphasize transparency and limit government intrusion into your personal finances. However, any shift would require widespread political will and public support, signaling a major transformation in how you contribute to federal revenues and how those funds are allocated.

Public Opinion and Political Climate Surrounding Taxation

Political attitudes toward income tax remain polarized, with many Americans feeling burdened by what they see as an unconstitutional and oppressive tax regime. This sentiment fuels calls for reform and challenges to IRS authority. As you navigate this landscape, you’ll find that understanding the political forces influencing tax policy helps you gauge when or if substantial change might occur, empowering you to make informed decisions about your taxes and civic engagement.

It’s important to recognize that public opinion heavily influences tax policy direction. While some advocate for maintaining the current system for governmental funding, others push back against what they view as excessive federal power infringing on your rights as a citizen. Your voice, alongside many others who question the status quo, is a key force that could steer America toward a tax system that preserves individual freedoms while balancing the nation’s financial needs.

State-Level Taxation vs. Federal Income Tax

To understand the ongoing controversy surrounding federal income tax, you need to explore how states approach taxation differently. While the federal government enforces income tax nationwide, several states have chosen not to tax personal income at all. This divergence highlights the tension between state autonomy and federal authority, raising questions about the limits of federal taxation powers and your rights under the Constitution. Examining these differences helps you grasp how taxation fits within the structure of American federalism and its constitutional implications.

Analysis of States Without Income Tax

Above all, states without income tax—like Texas, Florida, and Nevada—rely heavily on sales and property taxes, showing you alternative models to raise revenue without direct income taxation. These states often market themselves as havens for those opposed to federal income tax enforcement, illustrating how federal tax systems are not the only way to support government functions. For you, this indicates there are viable non-income tax frameworks that coexist within the Republic, questioning assumptions about the federal government’s tax reach.

Federal vs. State Rights in Taxation

To grasp how taxation powers clash, you must consider the constitutional balance between federal authority and state sovereignty. While the 16th Amendment empowers Congress to tax incomes without apportionment, states maintain their own taxing rights, sometimes conflicting with federal law. This ongoing tension can affect your tax obligations and legal standing, emphasizing the importance of understanding which government level holds legitimate authority over your earnings.

Considering the historical Supreme Court rulings like Pollock v. Farmers’ Loan & Trust Co. and later cases, the debate over federal vs. state taxation rights isn’t merely theoretical. It affects enforcement and compliance, impacting you directly. Some states have tested federal limits by adopting unique tax structures, challenging whether the federal government’s expansive income tax authority truly aligns with constitutional boundaries or if it infringes on your rights.

Lessons from State Reforms on Federal Tax Policy

Federal reforms inspired by state-level tax models demonstrate to you that alternative revenue systems can function effectively without relying on income tax. These experiments offer insights into how the federal government might recalibrate its tax policies, reflecting your concerns about tax legality and fairness. Such reforms highlight possibilities for reducing the burden on you while maintaining government services.

Without acknowledging these state-level innovations, you might overlook significant lessons on limiting federal tax intrusion. States have shown it is possible to maintain robust public services without imposing direct income taxes, proving that federal income tax is not the only means to fund government operations. This could empower your legal arguments for more balanced taxation respecting constitutional principles and your individual rights.

The Broader Impact of Income Tax Legislation

Your understanding of income tax laws reveals how deeply they affect not just government revenue but your everyday life. These laws influence your financial decisions, business operations, and the very structure of social programs. As debates continue about the legality of these taxes, it’s important for you to see beyond the surface, recognizing how income tax legislation profoundly shapes economic freedom, administrative authority, and public services that touch your community.

Economic Effects on Individuals and Businesses

At the individual and business level, income tax laws directly affect your earnings and growth potential. High tax burdens can limit your investment capacity and curb job creation, while confusing tax codes increase compliance costs. This often results in less money in your pocket and slower economic development, making it harder for you to build wealth or sustain a thriving business under restrictive fiscal policies.

Administrative Impacts of IRS Regulations

By enforcing complex tax statutes, the IRS exercises expansive administrative power that directly impacts your interaction with the government. These regulations create a bureaucratic maze, complicating tax compliance and exposing you to audits and penalties—even when misunderstandings arise. The administrative reach of the IRS represents a powerful tool that can intimidate and burden taxpayers, raising questions about the limits of such authority.

Consequently, the IRS’s administrative control over tax collection extends far beyond mere revenue gathering—it can affect your financial security and legal freedoms. The agency’s broad enforcement scope often results in aggressive tactics that may infringe on constitutional protections, leaving you vulnerable to costly legal battles. This growing administrative authority can undermine your confidence in fair tax enforcement and challenges the balance between government power and your individual rights.

Implications for Social Services and Government Programs

Among the various demands on federal income tax revenue, funding for social services and government programs significantly shapes your access to public benefits. These programs rely heavily on collected taxes, which means that changes or challenges to income tax legality could directly influence the availability and quality of services you and your community receive.

But if income tax enforcement is found unconstitutional, the ripple effect on social services would be profound. Without steady tax revenue, many programs could face severe budget cuts or collapse, affecting millions who depend on them for healthcare, education, and welfare support. Such instability raises urgent concerns about how government programs would adapt and whether alternative funding mechanisms could sustain important public needs without infringing on your rights.

Income Tax Enforcement: Legal and Ethical Considerations

After decades of controversy, federal income tax enforcement remains one of the most hotly debated issues facing you today. While the IRS rigorously pursues compliance, questions about the legality and ethics of these practices persist, especially given the ongoing debate regarding the Constitutionality of income tax. You should understand that enforcement agencies operate under complex laws that some argue conflict with original constitutional principles, making your awareness of both legal rights and systemic overreach vital in protecting your interests.

The Role of Whistleblowers and IRS Agents

Considerations surrounding whistleblowers and IRS agents shed light on enforcement practices you may never see. Numerous former IRS employees have testified that internal knowledge of taxing laws often contradicts public IRS positions, revealing a system sometimes enforcing tax laws beyond what the Constitution allows. These whistleblowers can be valuable sources of insider information, empowering you to question and challenge actions that may unfairly target your financial freedom.

The Debate Over IRS Audits and Their Fairness

Along with enforcement questions comes the ongoing debate about IRS audits and their fairness. Many taxpayers feel audits are administered inconsistently, sometimes appearing as intimidation tactics rather than impartial reviews. This debate raises concerns about whether you are being subjected to arbitrary scrutiny without adequate protections, highlighting a need for transparent and just audit procedures that respect your legal rights under the Constitution.

Plus, critics argue that the audit system disproportionately affects certain groups while allowing larger corporations to navigate loopholes with relative ease, creating an uneven playing field. This division fuels skepticism about the IRS’s role, encouraging you to stay vigilant and informed about how audits might impact your personal and financial well-being under a system some consider overreaching.

Legal Support for Taxpayers in Dispute

Across the growing tax controversy landscape, legal support for taxpayers in dispute provides vital protection that you can rely on. Organizations and attorneys who specialize in constitutional tax law stand ready to defend your rights when facing IRS challenges, emphasizing that enforcement must align with constitutional limits. Engaging knowledgeable legal counsel can make a significant difference in navigating IRS claims and safeguarding you from unlawful taxation.

Over recent years, legal advocates have successfully used arguments based on constitutional precedent, including cases like Pollock v. Farmers’ Loan & Trust Co. and Brushaber v. Union Pacific Railroad, to challenge federal income tax claims. These efforts underline the importance of having expert legal support, ensuring your defense is not only vigorous but rooted in the fundamental principles of American law and individual liberty.

The Public Perception of Taxation

All around you, the public’s view of federal income tax is deeply divided. While many accept it as a necessary obligation within the Republic, a growing number question the constitutional validity of this tax, especially given conflicting Supreme Court rulings and persistent debates over the 16th Amendment. Your understanding of these disputes shapes not only your compliance but also your trust in the system enforcing these taxes. By staying informed, you can better navigate the complex narratives surrounding taxation in America.

Societal Views on Duty vs. Burden of Taxation

Across communities, you’ll find contrasting opinions about taxation: some regard it as a patriotic duty important to funding government functions, while others see it as an oppressive burden unjustly extracted. These differing attitudes influence how you perceive your role in contributing to the Republic’s financial structure, especially given ongoing debates over whether the income tax itself is constitutional or a form of unlawful government overreach.

The Growing Movement Against Income Tax Compliance

Along with increased awareness of controversial Supreme Court rulings and the nature of the 16th Amendment, a significant movement is emerging that challenges the obligation to pay federal income tax. You may notice more people seeking legal strategies to resist or question IRS authority, fueled by doubts about tax legality and inspired by testimonies from ex-IRS employees exposing enforcement inconsistencies.

But this movement comes with risks. While it empowers citizens like you to question unlawful taxation, it also exposes many to severe penalties if they act without solid legal grounding. Understanding how the movement interacts with existing laws is important, so you don’t become vulnerable to dangerous consequences stemming from misunderstandings or misinformation about tax enforcement.

Misconceptions and Educational Efforts Related to Taxation

By improving your knowledge on tax law history and Supreme Court decisions, you can dispel common misconceptions clouding public debate. Many believe federal income tax is voluntary or unconstitutional, but these views often stem from incomplete information. Efforts to educate citizens help you distinguish between legal facts and myths, enhancing your ability to engage critically with tax issues and protect your rights effectively.

Public education initiatives aim to clarify what the 16th Amendment truly entails and highlight why some tax arguments lack standing in court. When you understand the legal background, it becomes easier to navigate the complex, often confusing landscape of tax laws and IRS enforcement, strengthening your position in any dispute and reducing the appeal of fraudulent or misleading claims.

Shocking! Supreme Court Ruled Income Tax Unconstitutional?

Drawing together the complex history and rulings, you might be surprised to learn that certain Supreme Court decisions challenged the constitutionality of income tax as enforced today. While the 16th Amendment provided Congress authority to levy income taxes without apportionment, the legal debates persist over its ratification and scope. If you question the legitimacy of federal income tax, it’s important to understand the constitutional arguments and past rulings that may support your concerns. Staying informed empowers you to engage with this ongoing debate as a law-abiding American citizen valuing constitutional integrity.

FAQ

Q: Did the Supreme Court ever officially rule that federal income tax is unconstitutional?

A: The notion that the Supreme Court declared federal income tax unconstitutional is a common misconception. While the 1895 case Pollock v. Farmers’ Loan & Trust Co. did challenge the constitutionality of certain direct taxes, it did not overturn the income tax system entirely. The subsequent ratification of the 16th Amendment in 1913 explicitly granted Congress the power to levy income taxes without apportionment among the states, effectively settling the constitutional debate. The Supreme Court later upheld the income tax’s legitimacy in cases such as Brushaber v. Union Pacific Railroad Co. (1916), confirming constitutional authority for federal income taxation.

Q: How does the 16th Amendment affect the legality of federal income tax?

A: The 16th Amendment to the U.S. Constitution states that Congress shall have the power to lay and collect taxes on incomes, “from whatever source derived,” without apportionment among the states and without regard to any census or enumeration. This language provided the clear constitutional basis for federal income tax, resolving controversies over whether income tax qualified as a direct tax requiring apportionment. Although some skeptics argue about the amendment’s ratification process or wording, it remains the prevailing legal authority empowering Congress to impose income taxes.

Q: Are there Supreme Court documents or rulings that prove income tax is unconstitutional? Where can they be found?

A: Searches for official Supreme Court documents claiming income tax is unconstitutional typically refer to outdated or misinterpreted decisions like Pollock. However, those rulings predate the 16th Amendment and do not override it. Current Supreme Court rulings and official case texts can be accessed through reputable legal databases such as supremecourt.gov or loc.gov. No valid Supreme Court decision today invalidates the federal income tax system as constitutionally authorized.

Q: Can individuals legally refuse to pay federal income tax based on claims of unconstitutionality?

A: Refusing to pay federal income tax on the grounds that it is unconstitutional is not supported by current law or court precedent. Courts have consistently ruled against tax protester arguments claiming income tax enforcement violates constitutional principles. Nonpayment exposes individuals to legal consequences including fines, penalties, liens, and potential criminal charges. It is advised for citizens who question tax laws to pursue constitutional change through legislative and judicial processes rather than unilateral refusal to comply with tax obligations.

Q: Why has the belief that federal income tax is unconstitutional persisted among some Americans despite legal rulings?

A: The persistence of the belief that the federal income tax is unconstitutional stems from complex historical debates, misinformation, and misinterpretations of court rulings and constitutional amendments. Tax protester literature often cites pre-16th Amendment cases out of context or questions the amendment’s legitimacy to cast doubt on the tax system. Additionally, philosophical objections to taxation fuel these claims. However, the legal foundation for the income tax has been affirmed repeatedly by Congress, the Supreme Court, and executive agencies, making the tax enforcement system constitutional under current U.S. law.