They Didn’t Just Mislead You – They Lied About Property Taxes

You weren’t just given half-truths about property taxes, you were fed a polished narrative that hides how aggressive and permanent this system really is. Your “civic duty” story skips the part where counties run tax-lien auctions, investors flip your debt, and people lose fully paid-off homes over a few thousand dollars. When a $2,300 tax bill can wipe out a $300,000 house, you’re not being served, you’re being leveraged.

Wait, What’s with This Property Tax Stuff?

You probably grew up hearing property tax keeps your roads paved and your kids educated, but nobody mentioned the fine print where missing a single payment can trigger penalties, liens, then foreclosure. In some states, your county quietly sells that tax lien to private bidders who profit off your hardship while you scramble to keep your title.

Is Property Tax Even Legal?

You might assume property tax is ironclad law, but the constitutional footing is way shakier than you’re told. Direct taxes were supposed to be apportioned, takings require just compensation, and due process isn’t supposed to look like a rubber-stamp tax sale hearing that lasts five minutes.

When you dig into court records, you find cases like Tyler v. Hennepin County (2023), where a 94-year-old woman lost her condo over unpaid taxes and the county tried to keep more than $25,000 in equity. The Supreme Court said that was an unconstitutional taking, which quietly exposed how far local tax systems had drifted from basic property rights. If the state can zero out your lifetime savings over a tax debt that’s a fraction of your equity, you’re not a true owner, you’re a perpetual revenue stream.

The Rollout of an Anti-Property Tax Movement

You’re not the only one side-eyeing this setup, thousands of homeowners are quietly building an anti-property tax movement. In Michigan, Ax MI Tax is chasing 500,000+ signatures, while Texas activists push multi-year plans to shift funding away from property and North Dakota organizers keep re-filing measures after a near-win.

What you’re seeing is less a tantrum and more a strategy: petitions, constitutional amendments, targeted lawsuits against abusive tax-lien seizures, and local candidates running on a single promise to phase out or cap property tax. Some groups are modeling systems that swap annual property taxes for broader consumption taxes or split-rate land value taxes that protect your home structure. The energy is coming from retirees on fixed incomes, young families priced out by rising mill rates, and investors sick of watching counties act like silent partners in every real estate deal.

Key Takeaways:

- Ever wondered if paying lifelong property tax means you never actually own your home outright?

- The property tax system feels like paying perpetual rent to government, even after your mortgage is fully paid.

- Many argue property taxes clash with the Constitution’s protection of life, liberty, and private property ownership.

- Seizing fully paid homes over unpaid taxes looks a lot like violating due process and the Fifth Amendment Takings Clause.

- Grassroots movements in Michigan, Texas, North Dakota, and Tennessee are pushing to abolish or phase out property taxes.

- Legal researchers say property tax creates a fake ownership setup where the state holds the ultimate claim, not you.

- A growing constitutional property rights wave is asking bluntly: if you must pay forever, is it really your property?

Let’s Dive into the Constitution – What’s It Really Say About Property?

In 1792, James Madison wrote that property in rights is just as sacred as property in land, and the Constitution quietly backs that up. You’ve got the Contracts Clause, the Takings Clause, Article I limits on direct taxes, plus state constitutions loaded with protective language. When you stack those against modern property tax systems that can strip your deed over a missed payment, the tension isn’t abstract at all – it hits your front door.

The Founding Fathers Were Serious About Our Rights

By 1789, you already had states like Virginia and Massachusetts writing that property is a natural, pre-government right, not some perk you beg for. The Founders read Locke, Blackstone, and Coke, and they obsessed over protecting your stuff from arbitrary power. They didn’t just talk about liberty in theory; they tied it directly to land, contracts, and inherited estates. When you read their letters, you see it clearly: if the state can control your property, it can quietly control your life.

The Fifth Amendment vs. Property Tax: A Hot Mess

In 1791, the Fifth Amendment dropped this bomb: “nor shall private property be taken for public use, without just compensation”. Property tax foreclosure flips that logic on its head. You can have a fully paid-off home, miss a year or two of taxes, and the county can sell it for pennies while you get nothing. That isn’t compensation, that’s a taking dressed up as “revenue.” So you’re left with a messy question: how is this not a direct violation of the very amendment that’s supposed to protect you?

Think about a 2020 example where a $40,000 home was taken over a tax bill under $2,000, and the owner walked away with zero – that’s the kind of Fifth Amendment nightmare we’re talking about. Courts often shrug and say “it’s a tax, not a taking,” even though you just lost your entire equity position because you couldn’t keep feeding a yearly bill. You’re not being paid fair market value; you’re being punished for nonpayment. So practically speaking, you’re coerced into paying rent to the state on your own land, which feels a lot closer to a forced taking than any honest, arms-length exchange.

Why Law Schools Seem to Ignore This Major Contradiction

In a typical 3-year J.D. program, you might get hundreds of hours on tax law, yet almost zero focused discussion on property tax vs. the Takings Clause. Professors teach “property tax is settled” like it’s gravity, and students memorize frameworks instead of questioning first principles. You’re trained to argue over assessment formulas, millage rates, and exemptions, not whether the entire scheme collides with due process. So by the time those students become judges, they’ve internalized the idea that raising revenue automatically legitimizes whatever the state does to your land.

Inside law schools, you’ve got casebooks curated by a tiny group of academics and publishers, and they mostly spotlight income tax or sales tax problems, not property tax foreclosure horror stories. Because the big bar prep companies and legacy firms benefit from a stable, predictable tax regime, nobody’s eager to hand you a framework that might blow up the status quo. You’re nudged toward debating margins, not questioning the core idea that the government can auction off your house to fund its budget. And once that mindset sets in, the constitutional contradiction around property tax gets treated like a fringe theory instead of a live legal question you’re allowed to ask.

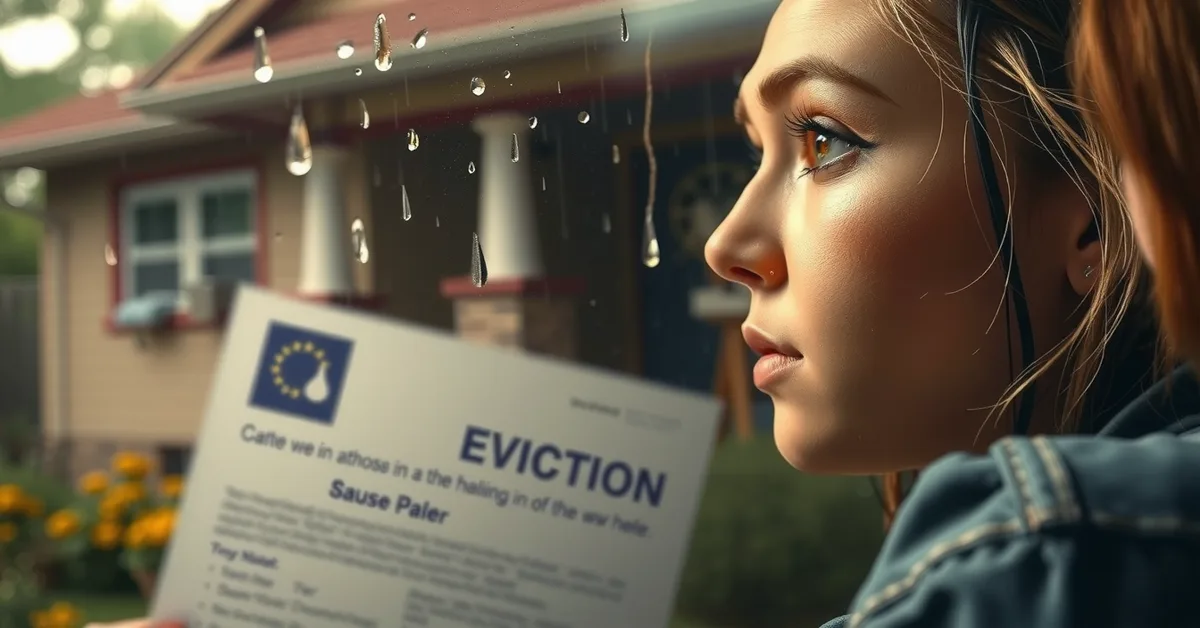

The Reality Check: Are Homeowners Just Renters in Disguise?

You probably felt it already: if you skip your property tax, the state can kick you out like any landlord. In 2022 alone, counties in states like Minnesota and New York seized homes over tax debts under $5,000, then sold them at auction. Your 30-year mortgage, your sweat, your upgrades – none of that stops a tax foreclosure. On paper you’re the owner, but in practice you’re a tax-dependent tenant with a very unforgiving landlord.

How Ownership Gets Twisted into a Lease with the State

Most people never read the fine print on their deed, yet the tax clause functions like a lifetime lease agreement. If you miss payments, your county can attach a lien, pile on penalties, then sell your place at a tax sale. In some states, like Illinois, investors literally bid on your tax debt and gain rights to your property. You keep paying, you keep “owning.” You stop, and your supposed ownership evaporates overnight.

Seriously, What Does True Ownership Look Like?

Real ownership means you can say “no” without losing everything, and right now you can’t do that with your home. When you buy a car in cash, the state can’t repossess it just because you refused to pay an annual “car property tax” forever. True property rights historically meant security: no forced sale, no endless tribute, no permanent meter running. If you’re never allowed to be done paying for your land, can you honestly call it yours?

Under classic common-law ideas, ownership meant three things: you control the property, you enjoy its benefits, and you can exclude others. You’re supposed to hold something like land in fee simple, the highest private title, without a perpetual payment tether. Yet with property tax, the state keeps a superior claim that can wipe out your title in one tax auction. So your control is conditional, your “rights” expire with unpaid bills, and your deed works more like a lease receipt than a shield.

The Insidious Lifetime Lease: Are We Too Blind to See It?

What’s wild is how normalized this lifetime lease has become, even though it behaves like a never-ending rent contract. You enter retirement thinking your mortgage is gone, then watch taxes climb 30, 40, even 60 percent in a decade, especially in fast-growing counties. Seniors in New Jersey and Texas report being forced to sell fully paid-off homes just to escape the tax burden. That’s not a glitch in the system – that’s the system doing exactly what it’s built to do.

In effect, property tax creates a quiet, compulsory lease where you pay the state for “use and occupancy” every single year. Counties budget based on your future payments, bond issuers treat your tax bill like a secured revenue stream, and you’re the collateral. Once you see it, it’s hard to unsee: your home is the asset, your tax bill is the rent, and your “ownership” lasts only as long as you keep feeding that meter. This is the lifetime lease almost nobody warns you about.

Why Are Property Taxes Keeping Us Hooked?

You’re not stuck in property tax by accident, you’re stuck because the system is designed to keep you dependent. Every time your county reassesses your home, your “ownership” gets more expensive, even if your income doesn’t budge. In places like New Jersey and Illinois, effective property tax rates hover near 2 percent of value, so a $400,000 home can quietly cost you $8,000 a year just to keep. That constant drain keeps you working, keeps you compliant, and keeps local government hooked on your wallet.

The Never-Ending Cycle of Tax Increases

Every budget cycle, you’re told the same story: higher assessments, “unavoidable” mill rate hikes, and scary threats about losing schools or police if you push back. In some counties, your property tax bill has doubled in 15 years while your income sure didn’t. Once your local government locks in that revenue stream, it rarely, if ever, goes down – it just resets higher as your home value climbs on paper.

Is There a Political Addiction to Property Tax Revenue?

There’s a reason nearly 75 percent of local tax revenue in some states comes straight from your property tax bill. City councils, school boards, and county commissions all build multi year budgets assuming your payments will rise like clockwork. When politicians know money shows up whether you vote, complain, or struggle, that looks a lot like addiction – predictable cash with almost zero accountability to you.

Think about how this plays out when you show up at a budget hearing in your county. You’re handed a glossy packet with projections, charts, and “needs,” but nobody asks if you consented to being a permanent revenue source. Because property tax is tied to your home, politicians know you’re trapped: you’ll pay to avoid foreclosure, even if it means credit cards, side gigs, or raiding savings you wanted for retirement. That’s why you almost never see serious proposals to replace property tax with voluntary, consumption based systems – they’d lose the guaranteed grip on your paycheck and your land, and they know it.

The Real Reason Some People Just Wanna Keep Property Taxes

Plenty of insiders absolutely love the current setup, even if they won’t say it out loud. Public sector unions, large school districts, and bondholders rely on your property tax payments to secure long term contracts and debt. When Wall Street underwrites municipal bonds, they literally treat your property as collateral through that tax stream, so of course they’ll fight any attempt to cut or abolish it.

Follow the money trail in any big county and you’ll see why some folks freak out at the idea of property tax abolition. Your taxes back billions in bonds for stadiums, convention centers, pension obligations, and fancy projects you never asked for but still pay for. Local insiders get predictable salaries, vendors get locked in contracts, and developers get sweetheart deals funded by “tax increment” schemes that skim your rising assessment. In that world, you’re not a homeowner, you’re the guarantor of everyone else’s promises – which is exactly why they’ll tell you the system is “for the kids” while they quietly protect their own revenue pipeline.

States Shaking Things Up: Who’s Leading the Charge Against Property Taxes?

Why are some states suddenly treating property tax abolition like a serious constitutional project, not a fantasy? You’re seeing states like Texas, Michigan, Tennessee, and North Dakota test how far they can push the limits of taxing authority, using ballot initiatives, constitutional amendments, and court fights. When you dig into these experiments, you start realizing something big: once people see a path to own your home without lifetime rent to the state, they don’t un-see it.

Movers and Shakers: States Trying to Ditch Property Tax

Which states are actually trying to pull the plug on property taxes instead of just whining about them every election cycle? In Michigan, the Ax MI Tax petition is chasing hundreds of thousands of signatures to abolish property tax and shift funding. Texas lawmakers keep filing constitutional amendments aimed at phasing out school property taxes using sales and consumption models. North Dakota’s 2012 Measure 2 lost with 76% voting no, but it sparked a permanent movement that still argues you should never lose your house over a tax bill.

What About Those States with No Property Tax?

So what about the unicorns everyone whispers about – states that supposedly live without property tax at all? You’ll often hear Alaska, Wyoming, and even Texas thrown around because they lean hard on oil, gas, and severance taxes instead of leaning totally on your house. A few states also rely heavily on state-level funding and sales tax to keep local governments afloat. The key lesson for you is simple: there are working models that don’t depend on threatening your deed every year.

When you dig deeper into these low or no property tax setups, the pattern gets interesting fast. States like Alaska, for example, allow some local property taxes, but the state government funds schools and services heavily with oil revenue, which takes pressure off your home. Others, like Nevada and Florida, cap assessments or homestead values so your tax bill can’t just balloon 20% in a year and shove you out of your own house. You’re basically seeing proof that governments can fund roads, cops, and classrooms using a mix of sales tax, energy revenue, tourism, and fees without putting a tax gun to your front door. It’s not perfect, it’s not clean, but it completely destroys the myth that property tax is the only thing keeping society from collapsing.

Grassroots Movements: It’s Time to Fight Back!

Who’s actually fighting for you while your property tax bill climbs higher every year and your paycheck doesn’t? In Michigan, Ax MI Tax organizers are knocking doors, explaining how a constitutional amendment could wipe out property tax and force spending transparency. Texas activists are flooding hearings, pushing lawmakers toward a phase-out timeline instead of empty “relief” talk. Even small counties in states like Tennessee are seeing citizen groups form legal funds to challenge takings and tax sales that stripped owners of equity.

Once you realize you’re basically renting from the state, grassroots action stops feeling optional and starts feeling like survival. You can plug into petition drives, public comment sessions, and lawsuits that target things like inflated assessments, unconstitutional tax sales, or the lack of true judicial review before seizure. Some groups even help you contest your tax valuation step-by-step so you’re not walking into the assessor’s office blind. The bottom line is this: when you and your neighbors organize, property tax stops being an untouchable sacred cow and starts looking like what it really is – a policy choice that can be changed, challenged, or abolished if enough of you push hard enough, long enough.

Can We Actually Argue That Property Tax is Unconstitutional?

In 2023, the U.S. Supreme Court unanimously struck down Minnesota’s “home equity theft” in Tyler v. Hennepin County, and that case handed you a loaded argument: if the government can’t keep extra equity after a tax sale, how can it justify threatening your entire home over an annual bill in the first place?

Legal Experts Weigh In – Are They Raising the Alarm?

Law professors like Ilya Somin and Pacific Legal Foundation attorneys are already warning that aggressive property tax foreclosure looks a lot like an unconstitutional taking, and if you zoom in on their arguments, they’re basically saying the quiet part out loud: your “ownership” is on life support if the state can zero it out with one tax lien.

The Tug-of-War Between the Fifth and Fourteenth Amendments

In plain English, the Fifth Amendment says government can’t take your property without just compensation, and the Fourteenth Amendment says it can’t do it without due process, yet property tax systems routinely let counties slap liens, pile on fees, and auction homes for a fraction of market value while you scramble through a maze of “notices” you probably never really saw.

So when your $250,000 house gets sold to cover $6,000 in back taxes plus penalties, you’re watching that Fifth vs Fourteenth Amendment tug-of-war play out in real time, because on one side you’ve got courts saying the state must pay for what it takes, and on the other side you’ve got bureaucrats hiding behind “procedure” to say you got due process, even if the result wiped out every dollar of your equity over a bill that was smaller than your last kitchen remodel.

Isn’t Taxing Homeowners Like Renting from the Government?

Once you realize that missing a $4,000 property tax bill can cost you a fully paid-off $400,000 home, it hits you that property tax works less like a normal tax and more like a perpetual rent check to the state, because if skipping a few payments means instant eviction and forfeiture, what you really “own” is the obligation to pay, not the land under your feet.

Because if your “ownership” disappears the moment you refuse to pay the annual fee, you’re functionally in a lifetime lease where the government is the real landlord, and that’s exactly why so many homeowners quietly say it feels like you’re renting your house from the county with a fancy deed stapled on top, especially when rising assessments turn your tax bill into a weapon that can push you out of the home you thought you’d secured for your kids.

The Human Side: What Property Taxes Do to Real Families

Ever wonder what all these abstract constitutional arguments actually mean for your daily life, your kitchen table, your sanity? When a county can slap you with a 20% tax hike in a single year, it’s not theory, it’s eviction pressure. Your “ownership” turns into a monthly anxiety test where one missed payment can wipe out decades of work, wreck your credit, and gut your kids’ sense of stability overnight.

Real Stories: People Losing Their Homes Over Taxes

Have you seen a neighbor’s house suddenly sprout a foreclosure notice even though their mortgage was paid off? In Illinois, a retired couple lost a fully owned $180,000 home over less than $7,000 in unpaid property taxes and fees. You’re told it’s your fault for “falling behind,” but the system is engineered so missing one step means losing everything, even when you’ve done almost everything right.

Don’t Forget About Seniors and Veterans Struggling with Taxes

Do you realize how many seniors and veterans are quietly being taxed out of homes they already paid for in full? Property tax bills doubling in 10 years hit hardest when your income is fixed and your body’s tired. You can win a war overseas or work 40 years, yet still lose your house at 78 because an assessor hit a few keys and “updated your value.”

In state after state, you’ve got vets on disability paying $5,000 to $8,000 a year just to stay in a basic 3-bedroom. Some places offer “homestead exemptions” or veteran discounts, but they’re often capped so low that rising assessments wipe them out in two or three years. And when you’re living on Social Security or a modest pension, one surprise reassessment letter can erase your grocery money, your meds, your sense of safety in a single envelope.

The Emotional Drain of Constant Home Payments

How many times have you stared at your tax bill and thought, “Does this ever end?” It’s like a second mortgage that never matures, no payoff party, no finish line. You plan vacations, kids’ college, even retirement around a bill you can’t opt out of, can’t negotiate, can’t escape without uprooting your entire life.

Every January, you’re basically waiting for a stranger with a spreadsheet to decide how stressful your year will be. Your inbox fills with escrow adjustments, new assessments, and those cheerful “tax impact” flyers that pretend this is all normal. Over time it wears on you: the late night calculator sessions, the quiet arguments with your spouse, the fear that one job loss or medical hit means you don’t just lose money, you lose your home – the place you thought was your safest bet.

What If We Had Alternatives? Exploring Different Models

Instead of being locked into a system where you pay perpetual rent to the state, you actually have options on the table. States are already testing models that shift revenue away from taxing your roof and dirt, toward what you buy, what you earn, or how land access is structured. Some proposals blend lower property tax with higher sales tax, others swap it out entirely for consumption-based tax systems that you can at least control with your spending choices.

Have You Heard About States That Don’t Tax Property?

Places like Hawaii, Alabama, and Louisiana already show you how wildly different property tax burdens can be, with effective rates under 0.4% while New Jersey hovers around 2.2%. Then you’ve got states such as Alaska and Nevada leaning heavily on severance, sales, and tourism taxes so your home isn’t the main ATM. When you compare those models, you start to see that taxing property the way many states do is a policy choice, not a constitutional necessity.

Is a Consumption-Based Tax a Better Way to Go?

Under a consumption-based tax, you’re taxed mainly when you spend, not just for existing on land you already own. Proposals like the national “FairTax” idea push for replacing income and property taxes with a broad sales tax paired with a prebate so basics stay affordable. States such as Florida and Tennessee already lean into this, collecting huge portions of revenue from sales and tourism instead of hammering homeowners. You get more control: spend less, get taxed less.

One big upside for your property rights is that a consumption-based system doesn’t threaten your deed every single year, because enforcement happens at the point of sale, not through tax liens and foreclosure. You’d still pay tax when buying a car, furniture, or a new TV, but your fully paid-off home wouldn’t be held hostage. Critics point out that sales taxes can hit lower-income families harder, which is why serious proposals build in rebates or exemptions on food, medicine, and basic necessities. If lawmakers actually cared about ownership, they’d be debating how to shift toward models where your house is no longer the collateral for government spending.

The Rise of a Land Rights Economy – What’s That All About?

In a land rights economy, the core idea is that you truly own your land, and access rights are separated from structures or productivity. Some versions draw from Henry George style models, where community captures a portion of land value while still protecting your improvements, others flip it and protect your title absolutely while charging transparent fees for shared infrastructure. You’re not just paying blind property tax anymore, you’re paying for clearly defined rights, services, and access you can actually audit.

Think about how different your life would be if your land title wasn’t effectively subordinate to the county tax office, but backed by a clear constitutional land rights framework. In some pilot projects and special economic zones, governments are experimenting with systems where you pay predictable, contract-like fees tied to service agreements instead of open-ended millage rates that jump every reassessment. That kind of land rights economy treats you less like a tenant and more like a stakeholder with enforceable claims. If those models scale, your “ownership” would stop being conditional on an annual payment and start looking like the secure property the Founders actually talked about.

The Movement Is Growing – Abolishing Property Taxes for Good

Why are you suddenly hearing more about abolishing property taxes in 2024 than ever before? Because what started as scattered frustration is turning into coordinated action – ballot initiatives, PACs, and lawsuit factories targeting tax foreclosure abuses in at least 8 states. You’re watching a slow shift from quiet compliance to open constitutional resistance, and if you own property, you’re already part of this story whether you like it or not.

How It’s Moving From Grassroots to Legal Battles

What happens when angry kitchen table rants turn into filed lawsuits and ballot language? You get exactly what you’re seeing now in places like Michigan, Texas, and Nebraska, where citizen groups have hired constitutional attorneys, drafted amendment text, and pushed court challenges after cases like Tyler v. Hennepin County (2023). Your outrage is no longer just emotional fuel – it’s legal ammunition aimed at the property tax machine.

The Power of Digital Campaigns and Citizen Activism

How did a niche “end property tax” idea start racking up millions of views on TikTok and YouTube? You and people like you began posting foreclosure stories, sharing screenshots of 40% tax hikes, and circulating petitions that once died in silence. Now Telegram channels, Facebook groups, and subreddits are coordinating signature drives, script templates, and FOIA requests, turning your frustration into a repeatable, trackable pressure campaign on local officials.

On a deeper level, those digital campaigns are doing something traditional lobbying never did for you: they’re teaching you the playbook in real time. You’ve got creators breaking down property tax case law in 90 seconds, Substack writers publishing sample complaint language, and volunteers auto-generating emails to county boards with one click. When a county threatens tax foreclosure, activists can flood their inboxes within hours, tag local media, and drop screenshots of past abuses. That network effect is why small wins – like refunds in a single unfair foreclosure case – suddenly go viral, inspiring you to question your own tax bill and pushing more citizens into this constitutional property rights fight.

Will the Supreme Court Have to Step In?

So what happens when 10 or 15 states start pushing conflicting rulings on property tax constitutionality? At some point, the U.S. Supreme Court is going to run out of ways to dodge the issue, especially after Tyler v. Hennepin County signaled that keeping “excess” equity from tax sales violates the Takings Clause. If your state keeps using aggressive tax foreclosure to scoop up homes, you may watch the Court finally decide how far government can go before your “property tax” morphs into outright unconstitutional seizure.

Digging even deeper, you’re likely to see a wave of strategic cases designed specifically to drag this question into the Supreme Court’s lap. Attorneys are already testing arguments that perpetual property tax turns you into a tenant of the state, conflicting with the original meaning of “private property” and the Fifth and Fourteenth Amendments. If multiple federal circuits split on whether certain tax foreclosure practices violate due process or just compensation, the Court almost has to step in. And when that happens, your monthly tax bill isn’t just an annoyance anymore – it becomes Exhibit A in a fight over whether you truly own your home at all.

My Take on the Real Ownership Dilemma

Most people assume once you get the deed, you’re golden, but your name on paper doesn’t stop forced tax auctions, 8% penalty fees, or full home seizures over a few thousand dollars. When counties rake in billions every year from property tax, your “ownership” starts to look more like a long-term lease you can’t cancel, and that’s the real dilemma you’re stuck in.

Are We Really Owners if We’re Always Paying?

Plenty of folks think as long as you’re current on payments, you’re an owner, but if skipping one tax bill in some states can trigger a tax lien, 18% interest, and eventual sale of your house, you’re not holding secure title, you’re managing risk. You’re basically paying annual protection money so government doesn’t list your home on an auction site.

The Obvious Truth About Property Tax and Freedom

People love to say property tax is just the price of civilization, yet if you can lose a $300,000 home over $3,000 in unpaid tax, that’s not freedom, that’s leverage. Your supposed private property becomes a bargaining chip the state can cash in whenever you stop feeding the system.

In case after case, you see how this really plays out for you on the ground: a retiree on a fixed income misses payments, the county adds layers of fees, then flips the house for market value while keeping every dollar above the tax debt, which the Supreme Court finally called home equity theft in the 2023 Tyler v. Hennepin County decision. That ruling didn’t kill property tax, but it exposed the core problem: your freedom shrinks fast when the entity that claims to protect your rights also holds the power to strip 100% of your equity because you fell behind.

Reclaiming What’s Ours – It’s About Time

Some people think you’re stuck with this forever, but you’re already seeing states experiment with sales tax swaps, consumption taxes, and property tax abolition amendments that replace yearly tribute with transparent systems you can actually opt into. Once you realize other models exist, paying rent to the state for life stops feeling inevitable and starts feeling like a policy choice you can challenge.

In practical terms, reclaiming what’s yours starts small but real: you support petitions like Ax MI Tax, you push your state reps to back phase-out plans tied to budget caps, and you talk to neighbors about how a 1% local sales tax shift could wipe out thousands from your yearly bill without gutting schools or roads. When you treat property tax as a negotiable policy instead of a law of nature, you open the door to true, tax-free ownership of your primary home, where your deed actually means what you thought it meant the day you signed it.

The Case for Collective Action – Let’s Rally Together!

Picture your county quietly auctioning off a neighbor’s paid-off home over a small tax bill while officials insist everything is “perfectly legal” and label your concerns as fringe or even “frivolous.” That’s exactly why you need to know what agencies like the IRS say in pieces such as The Truth About Frivolous Tax Arguments – Section I (D to …, then build smarter strategies. When you move in numbers, you convert isolated outrage into organized pressure that local power brokers can’t brush off.

Starting Local: Petitions, Protests, and Community Action

Instead of yelling at your tax bill alone at the kitchen table, you grab signatures, fill a town hall, and calmly demand answers about unconstitutional property tax practices. When just 200 to 500 homeowners in a county sign a targeted petition, officials suddenly respond, because you’re now a measurable voting bloc. Add carefully planned protests, media outreach, and coordinated testimony, and you turn your local property tax fight into a documented, undeniable political problem.

The Snowball Effect: How One Petition Can Trigger Change

Start with one focused petition in your city that questions property tax foreclosures or demands a cap on tax hikes, then watch copycat efforts spring up in neighboring towns. Once a county crosses a few thousand signatures, state legislators perk up, especially if you attach data on rising foreclosure rates or seniors losing homes. That single petition becomes a blueprint other communities use to challenge abusive property tax systems.

What really makes the snowball effect so powerful is how fast your effort scales once you give people something tangible to sign and share. You might begin with a simple Google Form or paper petition at local meetups, then suddenly your county group has 3,000 signatures, a Facebook community of 10,000, and homeowners in the next county asking for your template language. At that point, your “little” petition starts feeding coordinated lawsuits, ballot initiatives, and even model legislation, turning your frustration with unconstitutional property tax into a repeatable framework that other cities can adapt in weeks, not years.

Unite for Freedom: Joining Forces Across the Nation

Once your local property tax fight is mapped out, you plug into statewide and national networks so your story isn’t isolated but amplified. You compare notes with groups in Texas, Michigan, and North Dakota that already gathered tens of thousands of signatures to limit or abolish property taxes. By sharing tactics, legal arguments, and media strategies, you help build a multi-state coalition that pressures courts and legislators simultaneously.

When you start coordinating across state lines, everything shifts: you’re not just a frustrated homeowner, you’re part of a data-backed movement showing identical abuses in dozens of jurisdictions. You can swap attorney referrals, share sample complaints citing unconstitutional takings, and even sync petition deadlines so lawmakers see a wave of pressure in the same legislative session. Over time, those aligned efforts help create national property rights organizations, influence think tank reports, and feed into high-impact court cases, turning your individual fight against property tax abuse into a full-blown constitutional property rights campaign.

What You Can Do Right Now

So if property tax might violate your rights, what can you actually do today? You can support ballot initiatives, pressure legislators for constitutional amendments, and back lawsuits that challenge abusive tax forfeiture like the 2023 Tyler v. Hennepin County case. Even small steps – emailing your rep, signing a petition, showing up at one hearing – help build a record that this issue is not going away.

Get Involved: How to Join the Anti-Property Tax Movement

Ever wonder how you go from angry homeowner to someone actually shaping this fight? You plug into groups already doing the hard work: Ax MI Tax in Michigan, Texas Property Taxpayers Association, or local constitutional property rights coalitions. You show up on Zoom calls, share real stories of tax foreclosure harm, and help push signatures, funding, and turnout when repeal or cap measures hit the ballot.

Learning More: Resources to Educate Yourself and Others

Curious where to dig deeper without drowning in legal jargon? Start with the Tyler v. Hennepin County opinion, state constitutional articles on property rights, and work by scholars like Robert Natelson and Ilya Somin on takings and home equity theft. Then branch into think tanks like Pacific Legal Foundation and Institute for Justice that publish case studies, model laws, and step by step guides for homeowners fighting unconstitutional seizures.

One smart move is building your own little property-tax library so you’re not guessing when the assessor shows up. You can bookmark key cases, save PDFs of your state constitution, and follow ongoing home equity theft lawsuits on sites like CourtListener. When you share clips, charts, and before-and-after foreclosure stories with friends or neighbors, you’re not ranting, you’re showing receipts – real data, real victims, real wins in court.

Start Talking: Bringing the Conversation to Your Community

Wonder how this jumps from your browser to your neighborhood? You start small: a kitchen table meetup, a homeowner Facebook group, a short talk at a local church, homeschool co-op, or business meetup about how rising millage rates are quietly stripping equity. Add a couple of real cases from your county where people lost fully paid-off homes over small tax debts, and suddenly it’s not theory, it’s their street.

One of the fastest ways to shift opinion is to tie the issue to bills your neighbors actually pay right now. You can pull up your county’s annual levy growth, show a 15 or 20 percent jump in a few years, and ask if anyone’s income rose that fast. When people realize seniors, veterans, and single parents are losing houses over a few thousand dollars, they usually stop shrugging and start asking what they can sign, attend, or share next.

The Facts and Figures That Really Matter

Most people think property tax abuse is rare, but your risk is higher than you’re told. In Cook County alone, investigative reporting exposed a rigged property “tax sale” machine that stripped owners of homes for tiny delinquencies, a system a lawsuit calls unconstitutional. You can read how this plays out in real life in the Cook County property “tax sale” system unconstitutional case. If that can happen there, it can happen to your property too.

Statistics You Need to Know About Property Taxes

Most homeowners think property tax is just a few percent, but it quietly eats your paycheck. On average, you’re paying around 1.1% of your home’s value every single year in property tax, and in some counties that jumps over 2.5%. That means on a 350,000 dollar home, you could burn through almost 9,000 dollars in just three years… without touching your mortgage. That’s not a minor fee, that’s long term wealth extraction.

The Economic Impact of Property Tax on Homeowners

Most people assume property taxes are stable, but they actually move like a second mortgage that never dies. If your assessed value climbs 30% in a hot market, your tax bill can spike even if your income doesn’t, which is how long time owners get taxed right out of homes they already paid off. You’re not just covering schools and roads here, you’re funding a system that punishes you for improving your property or living in a growing area.

Real impact hits you in quiet, painful ways. You delay roof repairs, skip retirement contributions, or refinance just to cover a surprise escrow jump, then interest snowballs on top. Seniors on fixed income watch a lifetime of work get cornered by rising assessments until selling is the only exit, which is insane when the house is supposedly “yours”. And if values crash, your tax rarely drops at the same pace, so you eat the loss while the bill stays fat – that upside down risk is entirely on you, not the state.

State Comparisons: Who’s Winning and Losing?

Most folks think property tax rates are kinda similar everywhere, but the spread is wild. In places like New Jersey and Illinois, you’re staring at effective rates over 2% of home value, while states like Hawaii or Alabama sit closer to 0.3% to 0.4%. That means the same 400,000 dollar house can cost you under 2,000 dollars a year in one state and over 8,000 in another, which totally flips where you can realistically afford to live long term.

| State / Area | Approx. Effective Property Tax Rate |

|---|---|

| New Jersey | About 2.2% per year |

| Illinois | Roughly 2.0% per year |

| Texas | Roughly 1.6% per year |

| National Average (U.S.) | About 1.1% per year |

| Alabama | Roughly 0.4% per year |

| Hawaii | Near 0.3% per year |

State comparisons hit you hardest when you run the long game math. On a 500,000 dollar home held for 20 years, a 2% rate quietly drains about 200,000 dollars in property tax, while a 0.4% state takes only around 40,000, and that gap could have been your kids’ college fund or your entire retirement bridge. You’re not just picking a zip code, you’re picking how much of your lifetime earnings the government skims off your property, and once you’re locked in, moving isn’t cheap or easy.

Busting Myths: Common Misconceptions About Property Tax

Some myths about property tax sound reasonable on the surface, but once you dig into the constitutional angle they start falling apart fast. You’ve been told it’s fair, predictable, and necessary, yet states like Alaska and Florida prove you can fund services with far lower effective property tax burdens. When you stack those examples against forced annual payments under threat of foreclosure, the “normal” story you were sold stops adding up.

Debunking the Myths: What People Get Wrong

People keep repeating that property tax is “just part of owning a home,” but that flips ownership on its head. If your title can be wiped out over a few missed payments, you don’t truly own anything, you’re leasing from the state under a different label. And when counties pocketed hundreds of millions in surplus equity before the 2023 Minnesota case, it exposed how far that myth had drifted from constitutional reality.

Are Property Taxes Really Necessary for Local Services?

Supporters love to say you “need” property taxes for schools, police, and roads, yet the numbers tell another story. In Texas, lawmakers have mapped out plans to replace much of property tax revenue with broader consumption-based taxes while still funding core services. And Alaska runs without a statewide income or sales tax at all, relying heavily on resources and targeted revenues. So no, your local fire department doesn’t magically vanish the second property tax gets questioned.

What actually keeps your local services alive is revenue, not some sacred attachment to taxing your roof and dirt forever. You can fund schools using per-pupil state allocations tied to sales tax, impact fees on developers, or even land value capture on new commercial projects, instead of raiding your home equity every year. Some Texas proposals, for example, phase property taxes down as sales tax broadens, proving you can protect your property rights and still keep the lights on at city hall. The real issue isn’t possibility, it’s political will, because once officials taste stable property tax money they rarely want to give it up.

The Reality About Property Values and Taxes

People act like rising property values are a blessing, but for you that “gain” often shows up as a bigger tax bill. In states like New Jersey, effective property tax rates around 2% of assessed value per year mean a modest value jump can cost you thousands. That’s not wealth, that’s an involuntary withdrawal from your equity, one that never stops and can eventually push you out of the very neighborhood your taxes supposedly improved.

What you’re really dealing with is a system where appreciation becomes a weapon against your long term stability. Your county assessor bumps your value by 15%, your escrow jumps, and suddenly you’re scrambling to cover costs that didn’t exist last year, even though your income stayed flat. When retirees in states like California have to rely on Prop 13 caps just to stay put, it proves the underlying model is broken: the more you “succeed” on paper, the more the tax system punishes you. That’s not natural market movement, that’s policy deliberately tied to your home’s paper value, not your actual ability to pay.

To wrap up

Taking this into account, you’re not crazy for wondering if property tax crosses a constitutional line, especially after digging into ideas like When Tax Collection Is an Unconstitutional Taking. You’ve seen how your so-called ownership can feel more like a lease, and that nagging question in the back of your mind is worth listening to. So now it’s on you – keep learning, push back where it counts, and start treating your property rights like they actually matter.

FAQ

Q: Why are people suddenly saying property taxes might be unconstitutional?

A: Over the last few years, viral videos and podcasts have blown up this whole “property tax is sacred” narrative. Folks are connecting dots between property tax, the Takings Clause, due process, and old-school natural rights arguments, and realizing something big.

A: When your house can be seized over unpaid taxes, critics say that’s forced rent to the state, not genuine ownership.

A: This is why “They Lied to You – Property Taxes Might Be Unconstitutional” is turning into a full-blown constitutional property rights movement.

A: The trend isn’t just online either, lawsuits, petitions, and ballot measures are now pushing courts to face the property tax question head-on.

Q: How could property taxes violate the U.S. Constitution and natural property rights?

A: One of the biggest claims is that property taxes undermine the basic concept of private ownership protected by the Constitution.

A: If the government can take your land for nonpayment, critics argue your deed is really just conditional permission.

A: That hits the Takings Clause, which says private property can’t be taken for public use without just compensation.

A: Opponents say losing a fully paid home over a tax bill isn’t just compensation, it’s legalized equity theft hiding in plain sight.

Q: What constitutional arguments are people using against property tax systems?

A: First big point, taxation is supposed to be lawful, uniform, and based on genuine consent, not fear of losing your home.

A: Property tax is often called a perpetual lien that never disappears, which sounds more like a feudal obligation than modern ownership.

A: Activists argue this structure violates due process, because foreclosure can move faster than real, meaningful judicial oversight.

A: Some legal researchers also claim property taxes create a two-tiered ownership system, where the state holds the ultimate superior title.

Q: Are any states actually moving to abolish or radically cut property taxes?

A: Several states are already testing the waters, which is why this neps-level tax debate is suddenly everywhere.

A: In Michigan, the Ax MI Tax movement is pushing a constitutional amendment to eliminate property taxes and replace them with consumption taxes.

A: Texas leaders talk openly about long-term plans to phase out property tax using sales tax changes and spending caps instead.

A: North Dakota nearly passed a property tax ban, and activists there still treat that close call as proof this fight isn’t over.

Q: What would happen to schools and local services if property tax vanished?

A: Supporters of abolition say the “schools will collapse” argument is mostly fear-based and ignores creative funding options.

A: They point to states with comparatively low property taxes that still manage functioning schools through sales taxes and targeted fees.

A: Some economists suggest replacing property tax with transparent, voter-approved consumption taxes that feel more like actual consent.

A: Others propose neps-style hybrid systems, where land use fees are capped and can’t ever be used as a pretext to seize homes.

Q: Does property tax really make you a lifetime tenant instead of a true owner?

A: This is the emotional gut-punch of the whole debate, and people feel it every time a reassessment hits.

A: You spend decades paying off a mortgage, then realize missing one tax bill can undo your entire life of work.

A: Critics say if you must keep paying forever just to avoid losing it, you never actually own it in the first place.

A: That single realization is pushing many homeowners toward the nepq mindset that property tax is more like rent to the state.

Q: What can regular homeowners do if they think property taxes cross a constitutional line?

A: A lot of people start small, digging into their state constitution and local tax statutes to see where power actually comes from.

A: From there, they often join statewide petitions, Ax MI Tax style initiatives, or local property rights groups challenging assessments.

A: Some back strategic lawsuits, focusing on due process violations, excessive penalties, and takings issues in foreclosure cases.

A: Others push for constitutional amendments to cap, phase out, or replace property taxes entirely, forcing lawmakers to finally address consent.